Tax breaks for businesses

If you are an investor instead, go to the page dedicated to you

Tax breaks are a key opportunity for attracting investment in innovative startups and SMEs, as they offer significant benefits to investors. However, to ensure that these benefits are actually granted, companies need to be aware of the eligibility conditions and operational steps to be followed under the regulations.

Innovative startups

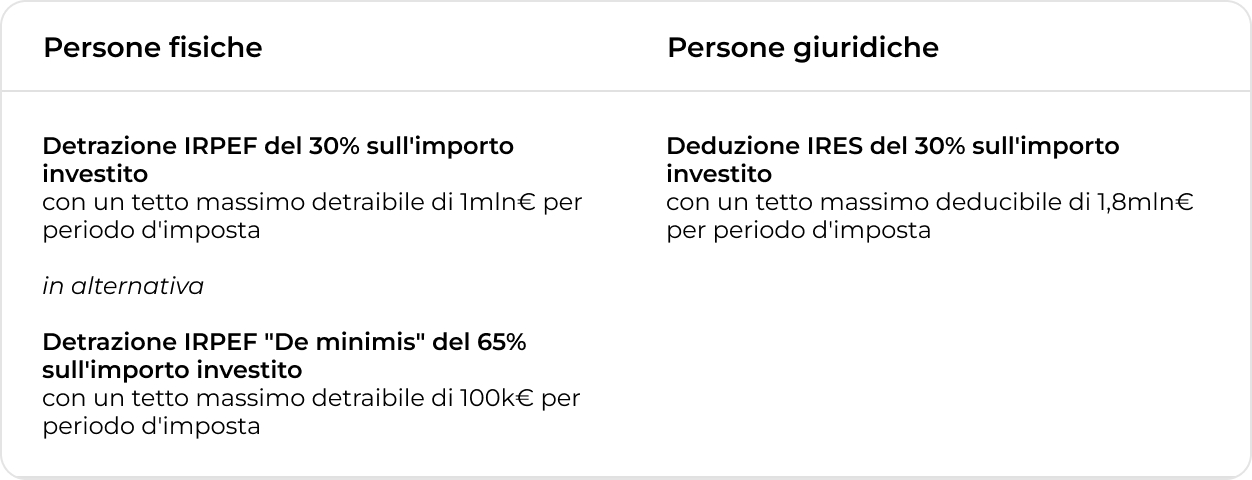

30 percent tax break

In order to be granted the 30 percent tax breaks, both to individuals and legal entities, the startup must make sure that, at the time it files the shareholder list with the Chamber of Commerce, it will have been registered in the special section of the Register of Companies for no more than 5 years.To verify that the status of innovative startup is maintained, it is necessary to refer to the annual law on the market and competition(see Law No. 193 of December 16, 2024), by which the relevant requirements have been updated, which can also be consulted at this page.

De minimis tax relief scheme of 65 percent

The de minimis facility is an alternative to the previous facility and allows for the granting, for individuals only, of a tax relief of 65 percent of the amount invested.

- Before granting this facility, it is necessary for the company to verify the available capacity by calculating its ceiling, taking into account previous de minimis aid received;

- The maximum de minimis relief that the company can grant to investors is €300,000 over a three-year period. The three-year reference period is calculated backwards by 36 months from the date the aid was granted;

- If the company has sufficient ceiling available and wishes to use it, then it can grant its investors the 65 percent tax break.

- In order to grant this tax break, the startup must make sure that, at the time it files the shareholder list with the Chamber of Commerce, it will have been registered in the special section of the Companies Register for no more than 3 years.

- Any transfer, even partial, of the investment before three years does not result in forfeiture of the benefit for cases of transfer that are independent of the taxpayer's will.

- Once the campaign has been completed, the startup must access the MIMIT (Ministry of Enterprise and Made in Italy) portal and fill out the appropriate de minimis aid report, entering data on each investor who is a beneficiary of the benefit. This fulfillment is mandatory for the validity of the tax benefit for investors and must be done by the date of release of the capital raised from the escrow account.

Practical example: capital increase of €600,000

- Hypothesis A) - the startup has not yet received de minimis aid and has the full available capacity (€300,000)

In this case, it can grant the 65% tax deduction only to the first investors who are natural persons for a maximum amount of €461,538, obtained from the following formula:maximum invested amount on which to grant de minimis = €300,000 ÷ 65%On theremaining portion of the capital increase of €138,462 (i.e., €600,000-461,538), the startup can grant the ordinary 30% tax deduction or tax allowance to investors.

- Hypothesis B) - the startup has already received de minimis aid and has a residual capacity of €180,000.

In this other case, the maximum invested amount on which it can grant the 65 percent tax deduction to investors is €276,923(180,000 ÷ 65 percent).On the remaining portion of the capital increase of €323,077 (i.e., €600,000-276,923), the startup can grant the ordinary 30 percent tax deduction or deduction to investors.

Innovative SMEs

Innovative SMEs can give the tax breaks to investors:

- if they have made their first commercial sale for less than 7 years;

- if they have made their first commercial sale for more than 7 but less than 10 years, if they have not yet sufficiently demonstrated the potential to generate returns;

- regardless of age, if they intend to make an initial investment for risk financing--based on a business plan drawn up for the launch of a new product or entry into a new geographic market--exceeding 50 percent of the average annual turnover for the past 5 years.

Operational steps to grant the tax break

1. Filing of the shareholder list with the Chamber of Commerce

Once the transaction has been completed, the company is required to file the list of new members with the Chamber of Commerce within 30 days from the date on which the capitals were released, even if the deadline for subscribing to the capital increase has not lapsed.Relevance of the filing date: The filing date of the shareholder list coincides with the date on which the investors formally become members and what will be considered the date of the investment, which has impacts on several tax and legal aspects, such as:

- tax year of the investment, which is important for the correct filing of tax returns;

- holding period: investors are only eligible for the tax benefit if they maintain the investment for a minimum period of 3 years, which starts from the date of filing the membership list.

2. Issuance of tax certificates

Once the shareholder list is filed, the company is obligated to issue tax certifications to investors within 60 days of filing the shareholder list with the Chamber of Commerce.The company can issue tax certifications through Mamacrowd within its personal area.

Warnings pursuant to art. 19 para. 2

the crowdfunding services provided by Mamacrowd do not fall under the deposit guarantee scheme established in accordance with Directive 2014/49/EU; the securities and instruments eligible for crowdfunding that can be acquired through this crowdfunding platform do not fall under the investor compensation scheme established in accordance with Directive 97/9/EC.

© 2026 Mamacrowd Srl a company of Azimut Group - VAT number IT07464370969 - Via Timavo 34, 20124 MI - SC € 95.417,54 fully paid up - Crowdfunding service provider authorised by resolution No. 22876 of 08/11/2023